price to cash flow from assets formula

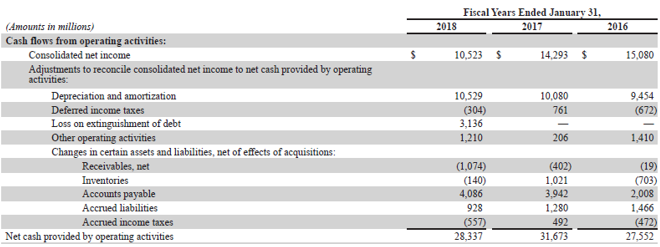

Calculating the Price - Cash Flow Ratio An Example. Operating cash flow is mentioned in the cash flow statement of the annual report.

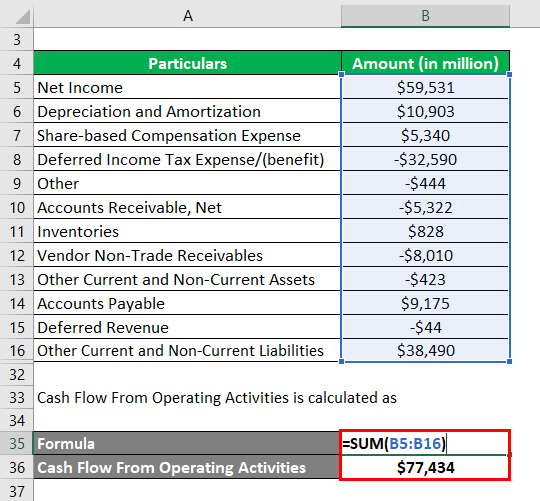

Net Cash Flow Formula Calculator Examples With Excel Template

Find a Dedicated Financial Advisor Now.

. The Fundamental Valuation Model. Net Asset Value Fund Assets Fund Liabilities Total number of Outstanding Shares. Market Cap is equal to the current share price multiplied by the number of shares outstanding.

PCF ratio market price per share cash flow per share. Market cap can typically be found with many stock quotes along with other common stock metrics. Shouldnt run into any problems.

The Price to Cash Flow ratio formula is calculated by dividing the share price by the operating cash flow per share. This cash flow is passed on to the investors as dividend. P C F P r i c e p e r S h a r e O p e r a t i n g C a s h F l o w p e r S h a r e.

Now lets use our formula. Price to Cash Flow Share Price Cash Flow per share. In this case Whimwick Studios would have a Cash Flow to Sales Ratio of 35 for 2019.

The price to cash flow ratio tells the investor the number of rupees that they are paying for every rupee in cash flow that the company earns. Cash flow per share Cash Flows from Operating Activities Weighted-Average Number of Shares 30 million 2 million 15 per share. The price to cash flow ratio is a pretty straightforward calculation.

85000 0 9000 -10000 66000. Thus if the price to cash flow ratio is 3 then the investors are paying 3 rupees for a stream of future cash flows of 1 rupee each. Rearranging the cash flow from assets equation we can calculate the cash flow to stockholders as.

However to find out this ratio we need to calculate cash flow per share. The Price - Cash Flow Ratio Formula. Do Your Investments Align with Your Goals.

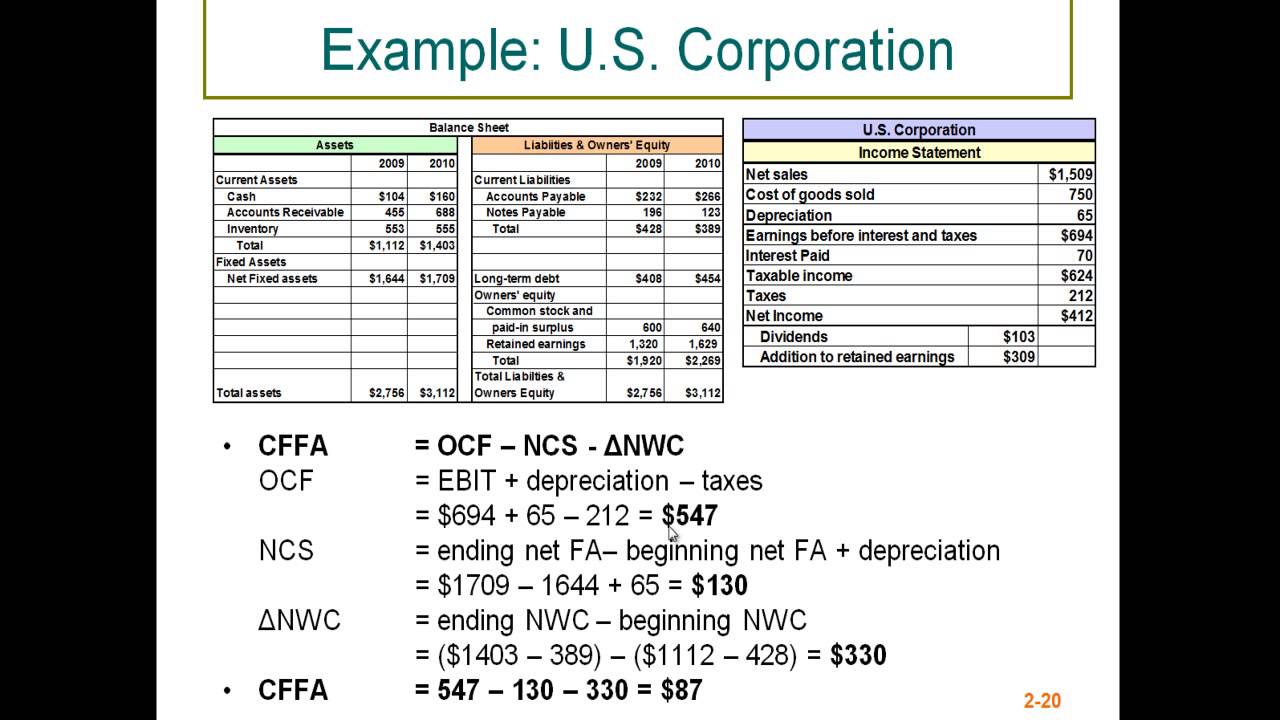

PCF dfrac Price. Next decide the discounting rate based on the current market return. This results in the following cash flow from assets calculation.

Price to Cash Flow Share Price or Market Cap Operating Cash Flow per share or Operating Cash Flow The PCF ratio equation can also be calculated using the market cap like this. You can be a profitable company but if you dont have cash moving around to pay bills then you are really in trouble. What is the cash flow from assets of this firm based on CFFA method 2 CFFA Method 2 CFCR CFSH CFCR interest paid net new borrowing o CFCR 44679 11412 35001 - 1119823 999244 -29587 CFSH dividends paid net new equity.

Therefore the company generated operating cash flow and free cash flow of 221 million and 93 million respectively during the year 2018. The cash flow from investing section shows the cash used to purchase fixed and long-term assets such as plant property and equipment PPE as well as any proceeds from the sale of these assets. Suppose Bajaj Autos current stock price is Rs 3135.

Firstly figure out the future cash flow which is denoted by CF. 12000 Cash flow generated by operations 10000 earnings 2000 depreciation -25000 Change in working capital 15000 payables - 30000 receivables - 10000 inventory -10000 Fixed assets -10000 fixed asset purchases -23000 Cash flow from assets. The formula for present value can be derived by using the following steps.

This ratio is super useful for investors as they can understand whether the company is over-valued or under-valued by using this ratio. The numerator market capitalization is the total value for all stocks outstanding for a company. The Price - Cash Flow Ratio Formula The PCF ratio is the market price per share divided by the cash flow per share.

Free Cash Flow Net Income Depreciation Change in Working Capital Capex. Ad An Edward Jones Financial Advisor Can Partner Through Lifes MomentsGet Started Today. Sales We can apply the values to our variables and calculate Cash Flow to Sales Ratio.

In case of Frost we need to estimate operating cash flows and then work out PCF as follows. A ratio of 030 30 is quite good Corys Tequila Co. Price of an Asset today PV of Future Cash Flows from the asset discounted at an appropriate discount rate This is a simple valuation framework that forms the basis for Discounted Cash Flow DCF Valuation and can be used to price almost any type of asset typically bonds and stocks The cash flows will vary from asset to asset --.

And their most recent cash flow per share. Cash flow is often overlooked when people analyze a company. Price to Cash flow Ratio Current Stock Price Cash Flow per Share 50 15 333.

Free Cash Flow Net Income Depreciation Change in Working Capital Capex Free Cash Flow 227 million 32 million 65 million 101 million Free Cash Flow 93. Randis operating cash flow formula is represented by. The price-to-cash flow also denoted as pricecash flow or PCF ratio is a financial multiple that compares a companys market value Market Capitalization Market Capitalization Market Cap is the most recent market value of a companys outstanding shares.

The formula for the Price to Cash Flows ratio or PCF is a companys market capitalization divided by its cash flows from operations. The market price per share is simply the stock price. It is the rate at which the future cash flows are to be discounted and it is denoted by r.

That means in a typical year Randi generates 66000 in positive cash flow from her typical operating activities. Free Cash Flow 227 million 32 million 65 million 101 million. The PCF ratio is the market price per share divided by the cash flow per share.

It relates a companys ability to generate cash compared to its asset size. Cash flow from assets Cash flow to stockholders Cash flow to creditors 146 Cash flow to stockholders 260 Cash flow to stockholders 406. Price to Cash Flow Ratio Formula.

Cash Flow to Sales 136200000 11600000 350400000.

Cash Flow Formula How To Calculate Cash Flow With Examples

Operating Cash Flow Formula Calculation With Examples

Net Cash Flow Formula Calculator Examples With Excel Template

Present Value Of Uneven Cash Flows All You Need To Know In 2021 Cash Flow Financial Life Hacks Financial Management

/dotdash_Final_Cash_Flow_Statement_Analyzing_Cash_Flow_From_Investing_Activities_Jul_2020-01-5297a0ec347e4dd8996f307b3d9d61ad.jpg)

Cash Flow Statement Analyzing Cash Flow From Investing Activities

Price To Cash Flow Ratio Formula Example Calculation Analysis

Free Cash Flow Formula Calculator Excel Template

Price To Cash Flow Formula Example Calculate P Cf Ratio

Price To Cash Flow Ratio P Cf Formula And Calculation

Fcf Formula Formula For Free Cash Flow Examples And Guide

Price To Cash Flow Ratio P Cf Formula And Calculation

Cash Flow Per Share Formula Example How To Calculate

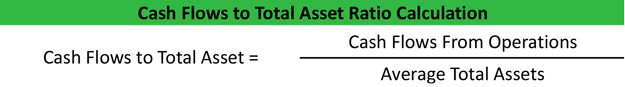

What Is Cash Flow On Total Assets Ratio Definition Meaning Example

Price To Cash Flow Formula Example Calculate P Cf Ratio

Cash Flow What Is It And What Is It For Efficy

Disposal Of Assets Disposal Of Assets Accountingcoach